Fascination About Opening Offshore Bank Account

Table of ContentsThe Basic Principles Of Opening Offshore Bank Account The 45-Second Trick For Opening Offshore Bank AccountHow Opening Offshore Bank Account can Save You Time, Stress, and Money.Opening Offshore Bank Account Things To Know Before You Get ThisSome Known Factual Statements About Opening Offshore Bank Account The smart Trick of Opening Offshore Bank Account That Nobody is Talking AboutThe Ultimate Guide To Opening Offshore Bank AccountA Biased View of Opening Offshore Bank AccountGetting My Opening Offshore Bank Account To Work

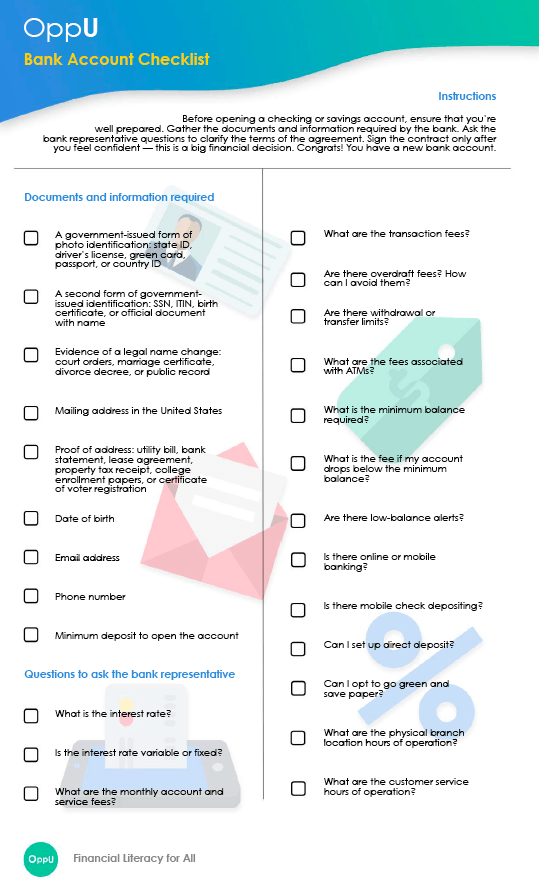

When you open this account, you'll have the alternative to secure an. A set up overdraft account allows you to borrow cash (up to an agreed limitation) if there's no cash left in your account. This can be beneficial if you're hit with an unexpected costs, for example. If a payment would certainly take you previous your arranged limit (or if you don't have one), we may allow you borrow using an.However, we'll constantly attempt to permit vital payments if we can. You can get a set up overdraft when you open your account, or any time later on. You can ask to boost, get rid of or lower your limit any time in online or mobile financial, by phone or in-branch.

See This Report about Opening Offshore Bank Account

We report account task, consisting of overdraft use, to debt recommendation firms. An unarranged overdraft lasting more than thirty day might have a negative influence on your credit report score. This account comes with a. If you go overdrawn by more than that, you'll need to pay interest on the quantity you obtain at the price revealed.

Whether you're thinking about relocating to the UK or you've shown up there currently, eventually you're going to require a financial institution account. In the past, opening up a savings account in the UK was really hard if you were new to the country. Luckily, nowadays, it's ended up being somewhat much easier.

Everything about Opening Offshore Bank Account

As soon as you've changed your address, ask your bank to send out a bank declaration to your brand-new address by message, and you'll have a record that confirms your UK address. If you do not have a proof of address in the UK and you need to open up an account, Wise's multi-currency account may be the best selection for you.

Can I open a savings account prior to I show up in the UK? Yes, you can. Your house financial institution may be able to establish a represent you if it has a correspondent financial connection with a British bank. Many significant UK banks additionally have so-called. These are designed particularly for non-residents, so they're an excellent choice if you don't have the papers to prove your UK address.

All About Opening Offshore Bank Account

Barclays, Lloyds, HSBC and also Nat, West all use worldwide savings account. Opening up a bank account from abroad or a worldwide account may not be the ideal choice for you. Very usually, you'll have to make a large initial deposit as well as commit to paying in a minimum amount of cash monthly.

This can make your checking account expensive to open up and also run, especially if you still don't have a task. There may additionally be various other restrictions. You might not be able to shut the account and also button to a much better offer till a set duration of time runs out - opening offshore bank account. The Wise multi-currency account.

The smart Trick of Opening Offshore Bank Account That Nobody is Discussing

Some banks are stringent with their needs, so opening up a bank account with them will be difficult. What is the most convenient savings account to open in the UK? It's usually easier to open an account with one of the - Barclays, Lloyds, HSBC or Nat, West. These financial institutions have this website actually stayed in business for a lengthy time and are really risk-free.

The are Barclays, Lloyds, HSBC as well as Nat, West. Let's take a look at what each of them need to provide. Barclays Barclays is just one of the oldest financial institutions in the UK; as well as has more than 1500 branches around the nation. It's likewise most likely among the simplest financial institutions to open up an account with if you're brand-new to the UK.

The Best Guide To Opening Offshore Bank Account

The account is cost-free and also features a contactless visa debit card as standard. You will not be able to utilize your account quickly. Once you're in the UK, you'll have to go to a branch with your recommendation number, ticket and also evidence of address in order to turn on the account.

Opening Offshore Bank Account Fundamentals Explained

You can contact consumer support using a live conversation, where you can go over the details of your application as well as ask any type of inquiries in genuine time. Other banks worth considering While Barclays, Lloyds, HSBC and also Nat, West are the four biggest financial institutions in the UK, there are also various other financial institutions you can examine.

Of training course, it's always best to look at what various banks have to use and see that has the best deal. You can get a standard present account at no month-to-month cost from many high road banks.

The Best Guide To Opening Offshore Bank Account

Many banks also have exceptional accounts that use extra advantages such as cashback on family bills, in-credit rate of interest and insurance coverage. However, these accounts will certainly usually have regular monthly costs and minimum eligibility requirements; and also you might not qualify if you're new to the UK. You'll likewise require to be cautious to stay in credit.

If you're not making use of one of your bank's ATMs, examine the maker. Numerous atm will certainly specify that they are complimentary. In official statement a similar way, some paid makers will alert you about costs before you can complete the deal. Making use of an Atm Machine outside the UK is never free. Lots of financial institutions will certainly charge a, which can be as high as 2.

7 Easy Facts About Opening Offshore Bank Account Explained

Wise is FCA controlled as well as uses advanced protection steps to maintain your cash risk-free, anywhere you remain in the globe. Sources: This publication is offered for basic details functions only and is not meant to cover every aspect of the topics with which it deals. It is not intended to total up to advice on which you must rely.